Announcing the Cardstack Token Generation Event

Announcing the Cardstack Token Generation Event

Catalyzing the experience layer of the decentralized Internet

This is Cardstack’s official Token Generation Event announcement, redirecting from https://cardstack.com/tge.

Read our second update. (March 13, 2018)

Read our first update. (February 14, 2018)

Cardstack Foundation is pleased to announce the allocation process and the token metrics for its upcoming Token Generation Event (TGE).

The Switzerland-based Cardstack Foundation will initiate a fundraiser, followed by a series of airdropped awards, so as to distribute tokens to interested participants of the Cardstack ecosystem.

Cardstack’s Token Generation Event is designed to balance the interests of multiple stakeholders so as to achieve these goals:

- Optimize the token allocation so that the three main participant groups in the Cardstack ecosystem — end-users, software makers, and analytic miners — have access to the right proportion of tokens at each stage of the growth of the ecosystem to maximize utility.

- Ensure regulatory compliance to all applicable laws and regulations, so the TGE can be conducted in an orderly fashion, as well as to minimize risks for the contributors as well as for the Foundation.

- Reward community members, especially those who joined Cardstack early in its growth phase, with a clear and fair process for participation regardless of the level of individual contributions.

Key Information about the Cardstack Token (CARD)

- Name: Cardstack Token

- Symbol: CARD

- Token Type: ERC20 on Ethereum

- Jurisdiction: Zug, Switzerland

- Hard cap: $35,000,000 in USD

- Soft cap: $10,000,000 in USD

- Token Created at TGE: 6,000,000,000 CARD

- Token Available for Public at TGE: 2,400,000,000 CARD (40%)

- Bonus for Pre-Allocation: 10%

- KYC/AML: Yes

- TGE Date: Q1 2018 (projected)

- Method of Contribution: ETH

- Whitelisting of Ethereum Address: Required for crowd fundraiser

- Individual Caps: Enforced by smart contract during crowd fundraiser

- Vesting Schedule: Foundation (5 years), Syndicate & Team (4 years), Ecosystem Initiatives (2 years)

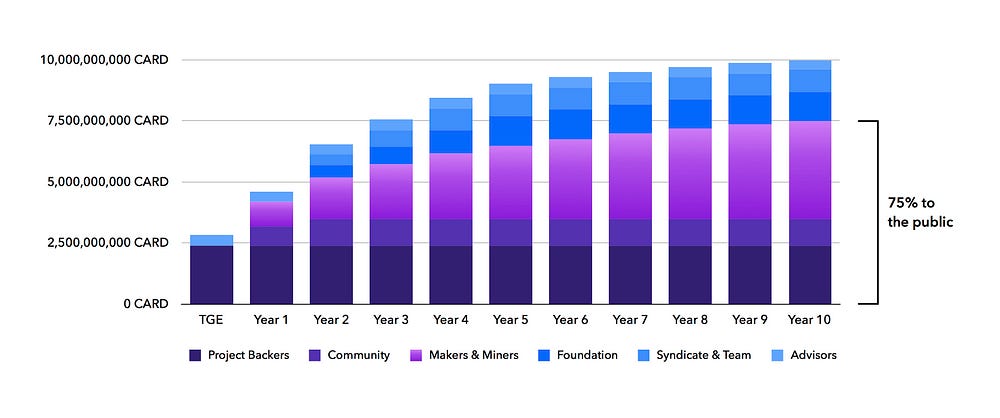

- Inflation / Mining Function: Additional 4,000,000,000 tokens distributed over 10 years to bootstrap reward pools for software makers and analytic miners

- Maximum Number of Tokens: 10,000,000,000 CARD in 2028

- Excludes Contributors From: United States, Cuba, Iran, North Korea

Token Distribution Phases

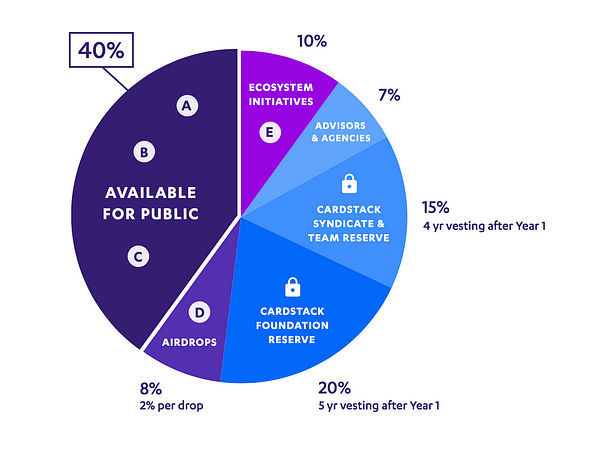

The Foundation will distribute 40% of the total of Cardstack Tokens (CARD) that will be generated at the Token Generation Event (TGE) to the public. These tokens will be distributed through a series of batches to ensure a fair allocation to our community of contributors, while maintaining compliance to applicable laws and regulations.

Early Contributors (Batch A): The first batch of tokens will be distributed to teams and individuals who have been active in the Cardstack community and have plans to continue to support and grow the ecosystem. This process is conducted manually and is subjected to KYC/AML (Know-Your-Customer / Anti-Money-Laundering) rules during on-boarding processes. Contributors in this batch may be offered a higher bonus reflecting the strength of potential strategic alignment.

Pre-Allocation (Batch B): The second batch of tokens is available on a first- come-first-serve* basis to members of the Cardstack community who wish to obtain an allocation of up to $50,000 USD equivalent of CARD and receive a 10% bonus. There is a minimum contribution of $1,000 USD for the pre-allocation. Interested parties will need to complete an on-boarding process operated by our pre-allocation partner, Bitcoin Suisse, prior to the start of the pre-allocation period. Approved participants will be able to contribute ether, or another cryptocurrency or fiat currency supported by the Bitcoin Suisse platform. Additional transaction fees may apply. For further details, please visit www.bitcoinsuisse.ch.

* Determined by the arrival of ETH funds for contributors that has successfully completed KYC/AML.

Community Building

To encourage the adoption of Cardstack software, architecture, and protocols, the Foundation aims to distribute the remaining tokens to the broadest network of participants possible.

Crowd Fundraiser (Batch C): The next batch of the tokens will be distributed directly through an open registration process on cardstack.com, where contributors who fulfill the KYC/AML requirements can contribute from a whitelisted Ethereum address up to an individual cap. For the first 6 hours of the crowd fundraiser period, the cap will be set at a relatively low number, ensuring that all approved contributors will have enough tokens to redeem Cardstack-based software and services.

To show our appreciation for those community members who have joined our community in its early days (on or before January 31, 2018), contributors with validated email addresses showing early participation will be granted a higher cap during these first 6 hours.

After these first 6 hours, all contribution caps will be raised.

Airdrop Awards (Batch D): Following the TGE, the Foundation will announce and conduct a series of airdrops that will further distribute tokens to potential, interested, and active participants of the Cardstack ecosystem.

Token Generation Event (2018)

The Cardstack Foundation will be generating 6,000,000,000 CARD during the Token Generation Event.

The majority of Cardstack Tokens will be distributed to end users, makers, and miners of the ecosystem. A portion of the tokens will be reserved for the Foundation and the Syndicate, which will vest on a linear schedule.

60% of the generated tokens will be distributed in Year 1 through: Early contributor agreements (Batch A), pre-allocation (Batch B), crowd fundraiser (Batch C), airdrops (Batch D), Year 1 ecosystem initiatives (1/2 of Batch E), and advisors/partners allocations.

40% will be available for public contributors (Batch A, B, C).

Allocated tokens will be available for peer-to-peer usage at the conclusion of the crowd fundraiser (Batch C), which will begin no more than 60 days from the conclusion of the pre-allocation period (Batch B).

The airdrop awards (Batch D) will occur throughout the first year, with each airdrop event limited to 2% of the generated tokens. There will be a public announcement at least 30 days before each distribution event, allowing interested participants to prepare their prerequisites for the awards. Possible examples of airdrops may include:

- Addresses on the Ethereum blockchain with more than a certain amount of ETH will receive an airdrop proportional to their ETH balance. The peer-transfer of airdropped tokens may require KYC/AML.

- Open-source projects that have cryptographically linked their GitHub repositories to an Ethereum address will receive an airdrop proportional to their GitHub statistics. The formula and analytics code will be published as an open-source module prior to this event.

- Product teams that have registered their app contracts and are actively running Cardstack software in production will receive an airdrop as a reward for early adoption.

Tokens slated for ecosystem initiatives (Batch E) can be allocated during the first two years, with half of the tokens in this batch unlocked via smart contract in Year 1 and the remaining half in Year 2. These tokens provide the Foundation with the flexibility to make early strategic partnerships, fund development and security bounty programs, and ensure token availability for large-scale enterprise or government projects.

Vesting for Reserve Tokens

There is a lockup period of at least one year for Cardstack Foundation Reserve Tokens, which then vest linearly over 5 years, whereas Cardstack Syndicate & Team Reserve Tokens vest linearly over 4 years after the 1 year lockup.

Ultimate Token Distribution (2028)

The maximum number of Cardstack Tokens ever in circulation is 10,000,000,000 CARD.

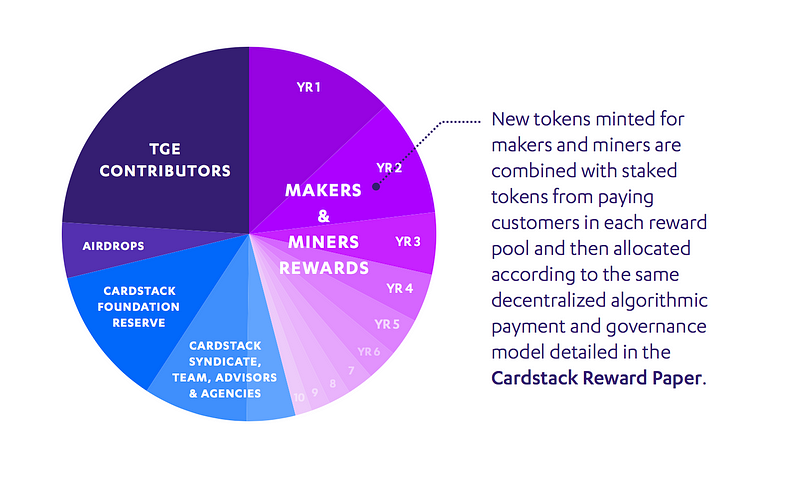

Mining Reward

To encourage participation of software makers and analytic miners early in the project’s adoption cycle, especially before a meaningful number of paying customers arrive, the Cardstack Token smart contract will mint and allocate 4,000,000,000 additional tokens over 10 years, whereafter the smart contract will automatically stake newly minted tokens in reward pools and then allocate them to makers and miners that are actively offering software and services.

During the first year, 1,000,000,000 tokens will be distributed incrementally over the course of the year. In subsequent years, the amount of distribution will be diminished, with the cumulative distribution at the end of each year capped by this formula:

6,000,000,000 * ( y / ( y + 5 ) )

Pre-allocation Process

The Cardstack team is working to identify a streamlined process to on-board the hundreds of community members who have reached out with interest to participate in a pre-allocation. We will update the community via Telegram as well as email when we have further updates.

Existing community members who have sent an email to token@cardstack.com or a message via Telegram showing interest in pre-allocation, on or before January 31, 2018, will be given priority in case there is a queue or cutoff for KYC/AML processing.

We plan to create additional opportunities for contribution so that all interested members of the community can participate in the TGE.

A Note about Contributions from the US

Due to regulatory uncertainty around tokens and cryptocurrencies in the United States, on the advice of our US legal counsel, citizens or residents of United States of America will not be allowed to participate in this token event.

TGE Date

The date of the TGE has not yet been determined, but it is likely to take place in Q1 2018. The exact date will be announced later.

Token Pricing

The price of the Cardstack Token (CARD) in ETH will be set by the Foundation close to the TGE start, as ETH-to-USD prices will likely fluctuate between now and then. Once the ETH price is set in the smart contract, it will remain at that value until the TGE is over.

For the purpose of determining whether the USD-based hard cap is reached, contributions in ETH are simultaneously tracked off-chain in USD using an exchange rate of a major exchange at the time of the arrival of funds.

The estimated price of a CARD at TGE is $0.017 USD.

To learn more about Cardstack and this upcomingToken Generation Event (TGE), visit https://cardstack.com to read our white paper, download the one-pager, watch a short intro video, and sign up for our mailing list.

To be notified with news about the Cardstack TGE, join the Cardstack community channel on Telegram at https://t.me/cardstack.

Description of Token Functionalities

The Cardstack project implements a payment and governance mechanism that facilitates the usage of software and services via a hybrid token acting as a utility token, a work token, and a reward token.

For end users, the project token is a utility token that allows them to mix and match multiple dApps and cloud apps. When users spend a project token, the smart contract forms a retainer agreement between the users and their chosen apps before the token is staked in a reward pool.

Software developers and service providers, whom we collectively call makers, can offer their dApps or cloud apps to users as part of the project’s ecosystem; they register their apps by paying a fee, thus using the project token as a work token. The fees to be paid by makers are determined by the smart contract, so as to balance the goals of inviting new entrants and maintaining quality. Maker fees, once paid, are locked in a toll pool and taken out of active circulation.

Tokens staked in the reward pool by users are periodically distributed to makers as reward tokens, according to a decentralized algorithmic payment and governance model that rests in the hands of the community. This model is driven by anonymized usage data, which is aggregated and tracked by an on- and off-chain protocol called Tally. Analytic miners help calculate the reward function that determines who gets paid out what, while sifting out spam, therefore making the system fair and resilient. The miners’ results compete in a sortition scheme we call Proof-of-Analytics, ensuring that the reward algorithms are never under a single party’s control.

Analytic miners can register to participate in the Proof-of-Analytics scheme, in order to determine how the reward pool is split, by paying a fee for every life cycle of the reward pool. These fees are paid as work tokens and locked in a toll pool as well. If a miner is selected to report the final payment splits, that miner receives a portion of the tokens in the reward pool as a mining reward for doing the useful work of number crunching and enforcing the community’s payment and governance model.

The percentage of tokens in the reward pool to be paid to miners is determined by the same decentralized algorithms that aim to minimize on-chain transaction fees in aggregate for end users and makers, yet ensuring protocol security by giving a critical mass of analytic miners incentives to compete.

To increase their chance of being selected, analytic miners can stake additional project tokens in a long-term stake pool called the voting pool. The odds of being selected through the sortition scheme are proportional to the size of a miner’s long-term stake. Miners who have tokens locked in this long-term pool can, however, have their stake slashed by the smart contract, if the results of their analytics are deemed to be fraudulent or out-of-consensus with the community.

Users and makers can also stake project tokens in the voting pool to influence the allocation parameters, smart contract upgrades, analytic algorithm changes, etc. For the purpose of allowing project token holders to influence the governance of the ecosystem, a variant of quadratic coin lock voting, which was proposed by Vitalik Buterin, is implemented in the smart contract. This way, voters who want to wield power through voting must live with their decisions for longer and align their interests with the long-term value of the ecosystem. Staked tokens in the voting pool can be retrieved after the lock-up period has elapsed.

Early on in the project ecosystem’s growth, newly minted tokens are automatically staked by the smart contract, in order to bootstrap the reward pools with a meaningful number of project tokens, so as to attract makers and miners to participate. As more end users arrive, the new revenue these paying customers bring in will become a major portion of these reward pools, allowing the ecosystem to transition into a sustainable, decentralized software market.

Disclaimer

Nothing herein constitutes an offer to sell, or the solicitation of an offer to buy, any tokens, nor shall there be any offer, solicitation, or sale of Cardstack Tokens (CARD) in any jurisdiction in which such offer, solicitation, or sale would be unlawful. You should carefully read and fully understand this white paper and any updates. Every potential token contributor will be required to undergo an onboarding process that includes identity verification and certain other documentation, which you should read carefully and understand fully, because you will be legally bound. Please make sure to consult with appropriate advisors and others.

For more information please visit our official website

WEBSITE | ANNTHREAD | WHITEPAPER | TWITTER | FACEBOOK | TELEGRAM | REDDIT | BLOG | CRYPTOCOMPARE

Komentar

Posting Komentar